The International Organization of Securities Commissions (IOSCO) has published the following final reports on 26 May 2025:

- Final revised Recommendations for Liquidity Risk Management for Collective Investment Schemes as an update to their earlier 2018 recommendations (the “Revised Liquidity Recommendations”).

- Final Guidance for Open-ended Funds (OEF) for Effective Implementation of the Recommendations for Liquidity Risk Management (the “Implementation Guidance”).

Background

In December 2023, the Financial Stability Board (“FSB”) published its Revised Policy Recommendations to Address Structural Vulnerabilities from Liquidity Mismatch in Open-ended Funds (the “Revised FSB Recommendations”) and, to support the greater use of and greater consistency in the use of anti-dilution liquidity management tools (“LMTs”) by OEFs, IOSCO published its Anti-dilution Liquidity Management Tools – Guidance for Effective Implementation of the Recommendations for Liquidity Risk Management for Collective Investment Schemes (the “IOSCO ADT Guidance”).

The Revised Liquidity Recommendations, amend the IOSCO 2018 Liquidity Recommendations (the “2018 Recommendations”). The aim of the revisions is to operationalise the Revised FSB Recommendations and incorporate other changes to reflect market and policy developments since the publication of the IOSCO 2018 Liquidity Recommendations.

Revised highlights

The Revised Liquidity Recommendations make changes to most of the recommendations, and we have chosen the following to highlight.

The CIS Design Process Recommendations

Recommendation 3 – Consistency of OEF asset liquidity and redemption terms

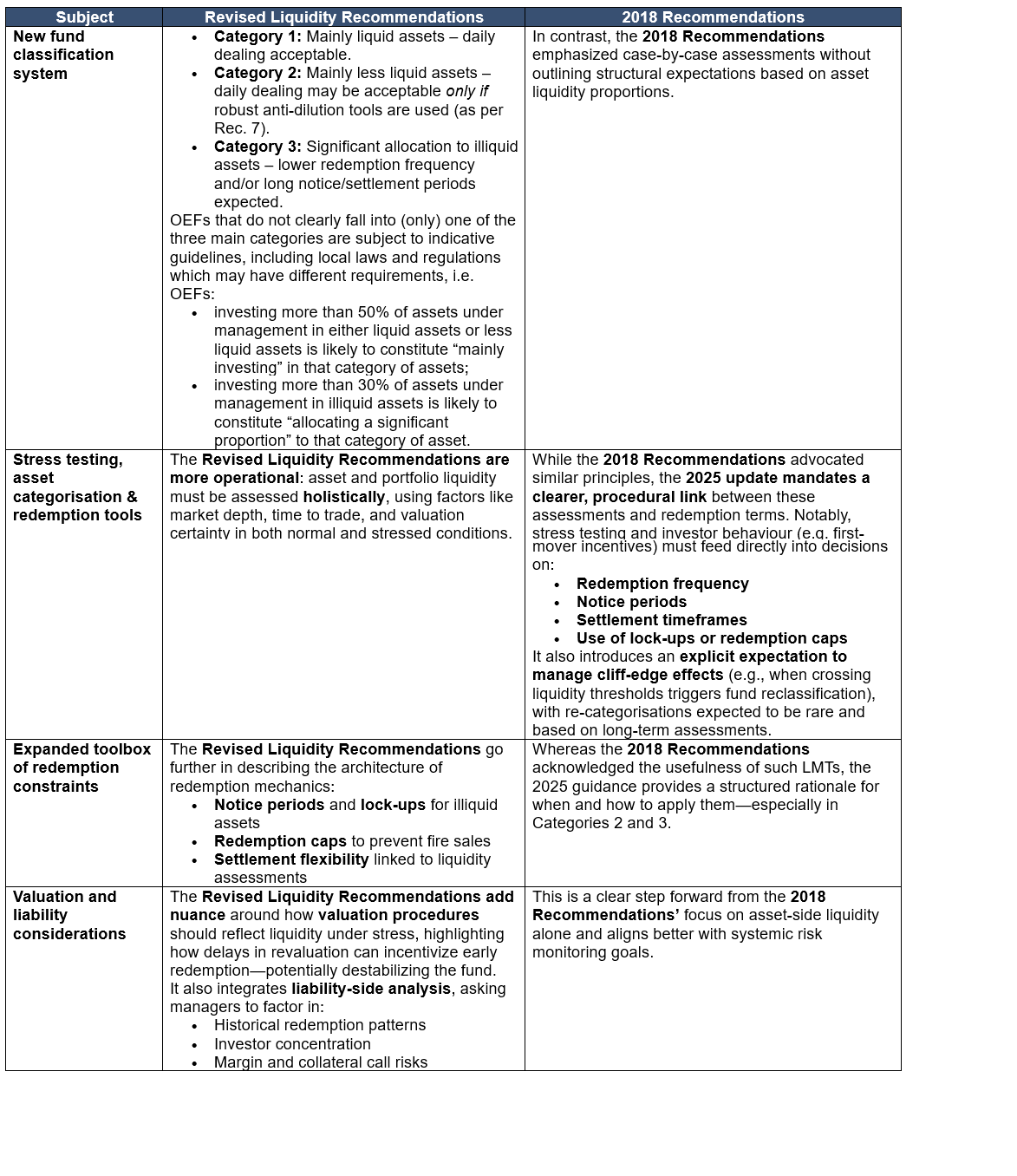

The Revised Liquidity Recommendations shifted their focus on introducing a more structured, granular approach to aligning redemption terms with underlying asset liquidity, thus marking a significant evolution from the broader principles set out in the 2018 Recommendations.

Click here to view a larger version of the table

Liquidity Management Tools and Measures Recommendations

Recommendation 6 - General consideration of anti-dilution LMTs, quantity-based LMTs and other liquidity management measures in both normal and stress conditions

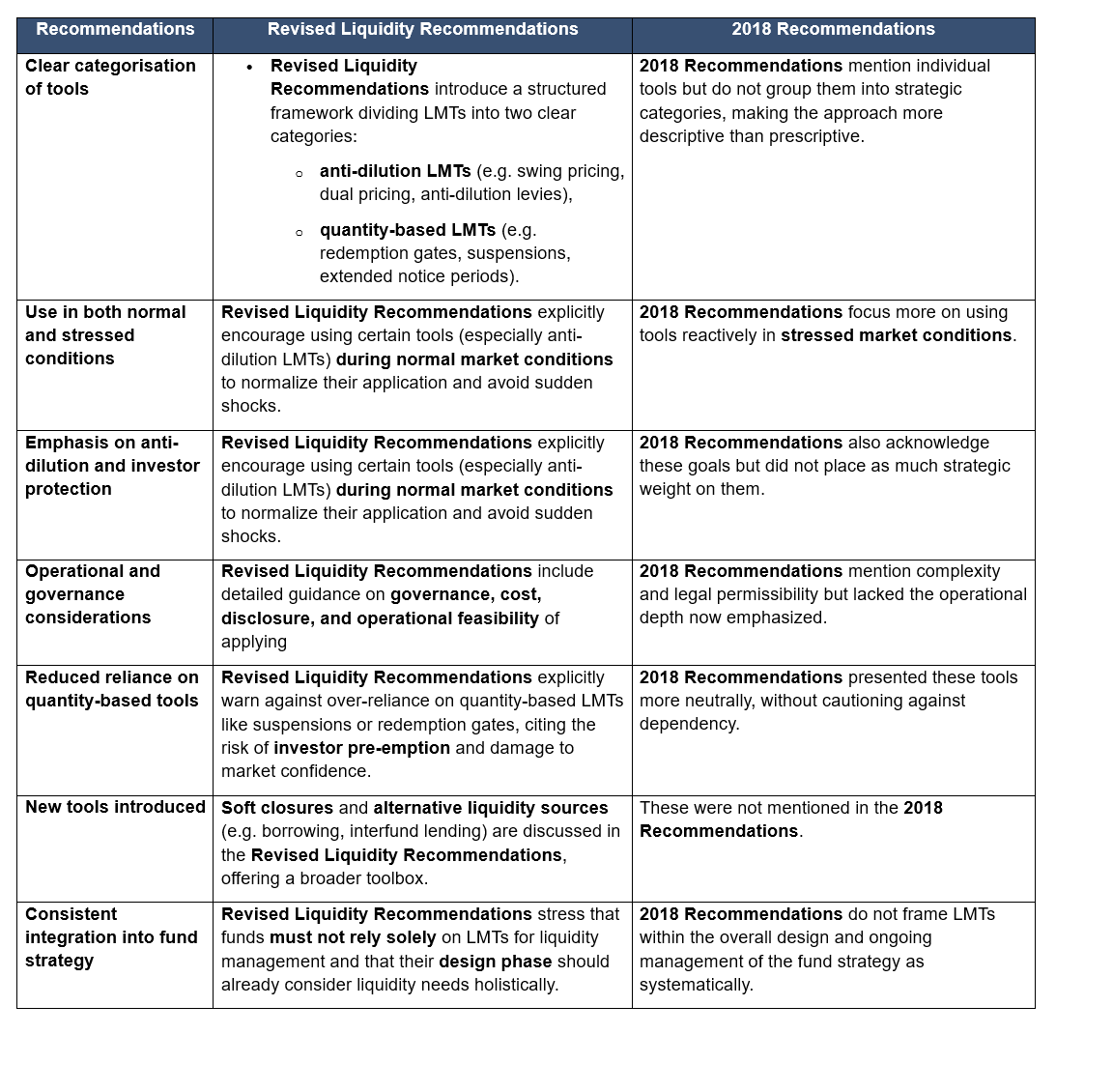

In comparison to recommendation 17 from the 2018 Recommendations, recommendation 6 from the Revised Liquidity Recommendations portrays a shift in focus and structure.

Click here to view a larger version of the table

The Revised Liquidity Recommendations reflect a more proactive, structured, and investor-focused approach to liquidity risk. It promotes ongoing integration of LMTs into fund operations and governance rather than limiting their role to crisis management.

Following: implementation review

IOSCO expects that securities regulators will actively promote the implementation of the Revised Liquidity Recommendations by responsible entities within the context of the relevant collective investment scheme (CIS) in their respective jurisdictions. Hence, the implementation of the recommendations (as revised) may vary from jurisdiction-to-jurisdiction, depending on local conditions and circumstances.

IOSCO will review progress by member jurisdictions in implementing the Revised Liquidity Recommendations and the Implementation Guidance. The review process will begin with a stocktake, to be completed by the end of 2026, of the measures and practices adopted and planned by member jurisdictions. IOSCO will aim to coordinate this stocktake with the FSB’s stocktake of the measures and practices adopted and planned to implement the Revised FSB Recommendations, to provide a comprehensive picture. The findings from this stocktake will feed into an assessment of whether implemented reforms have sufficiently addressed risks to financial stability, including, if appropriate, whether to refine existing tools or develop additional tools for use by responsible entities across the relevant jurisdictions.

Share on