Our publications

BSP’s lawyers regularly share their knowledge through regular legal updates, newsletters and professional publications.

Latest Newsletters & Newsflashes

Apr 22, 2024ECJ rules on deductibility of input VAT for “non-operating companies” (C-341/22)

On 7 March 2024, the Court of Justice of the European Union (“ ECJ”) handed down a judgment regarding the right to deduct input value added tax (“ VAT”) for a company which was deemed “non-operational” by the national tax authority. In the case at hand, a company carried out an economic activity of

Apr 19, 2024Vidéo Uplawder | Les spécificités de l'arbitrage au Luxembourg

Notre Partner Fabio Trevisan a présenté l’arbitrage au cours d’une interview vidéo Uplawder . Plus précisément, il évoque dans cet entretien (i) ce qu'est l'arbitrage ; (ii) les spécificités de l'arbitrage à Luxembourg ; (iii) ses avantages ; (iv) les bonnes pratiques ; ainsi que (v) ses retours d

Apr 19, 2024Appreciation of the 90% threshold in the context of Article 157ter LITL | The Lower Administrative Court decision

In a judgment dated 7 February 2024 ( docket No. 46783 ), the Luxembourg Lower Administrative Court ( Tribunal administratif ) (the “ Court”) handed down a decision concerning the application of the provisions of Article 157 ter of the Luxembourg income tax law (“ LITL”), allowing non-resident

Apr 19, 2024Luxembourg Law of 7 August 2023 on business continuation and modernisation of Bankruptcy Law | Recent case law developments

Following the entry into force of the Luxembourg law of 7 August 2023 on business continuation and modernisation of bankruptcy law (the “ Law”) on 1 November 2023, the Luxembourg courts have handed down several decisions clarifying the scope of application of judicial reorganisation proceedings, the

Apr 17, 2024Listing Act | Multiple vote share structures: provisional agreement reached by Council and Parliament

On 14 February 2024, the Council and the European Parliament have reached a preliminary agreement on the directive on multiple-vote share structures in companies that seek the admission to trading of their shares on an SME growth market (the “ Proposed Directive”). The Proposed Directive is part of

Apr 16, 2024Previously published in Tax

Newsflash | Pillar Two - The Luxembourg Tax Authorities issue a first FAQ Newsflash | Tax measures in favour of the Luxembourg real estate sector

Latest Brochures

Feb 12, 2024ELTIF in a nutshell

The ELTIF was created by Regulation (EU) 2015/760 on European Long-term Investment Funds of 19 May 2015 (and effective from 9 December 2015) (the “ ELTIF 1 Regulation”). The European Long-Term Investment Fund (“ ELTIF”) is a type of collective investment framework allowing investors to invest money

Jun 01, 2023BSP General Brochure

In this brochure you will find the description of all the activity that we can put in place for you. BSP is an independent full-service law firm based in Luxembourg, committed to providing the very best legal services to our domestic and international clients in all aspects of Luxembourg business

Mar 31, 2023Dispute Resolution Brochure

BSP’s dispute resolution practice assists domestic and international clients in a wide range of complex and high-stake and/or international disputes (litigation and/ or arbitration proceedings) in all major substantive areas of the law. Our dispute resolution team can be involved at every stage of

Jul 28, 2022RAIF | Reserved Alternative Investment Funds

This leaflet presents a focus on the Reserved Alternative Investment Fund (RAIF), a new and flexible alternative investment vehicle approved by the Law of 23 July 2016, which entered into force on 31 August 2016 (the RAIF Law). The RAIF Law creates a new type of unregulated fund which has many of

Jul 27, 2022Banking & Finance Brochure

BSP’s banking and finance team assists local and international market players on all regulatory and transactional aspects of Luxembourg banking and financial matters. Our lawyers are reputed for their extensive experience in bank lending, debt capital markets and structured finance, in particular

Jul 27, 2022Tax Brochure

Our Tax practice brochure gives an overview of the services our team of lawyers provides to domestic and internatonal clients in all Luxembourg tax related matters.

Latest Articles & Books

Mar 12, 2024Lexology | Litigation Funding 2024

Our experts have contributed to the publication of a Q&A paper about Litigation Funding in Luxembourg together with Nivalion AG. Look at the chapters below, which are fully investigated in the pdf. REGULATION Overview Restrictions on funding fees Specific rules for litigation funding Legal advice

Feb 12, 2024Chambers | Investment Funds 2024 Guide

The Investment Funds 2024 guide covers 20 jurisdictions. The guide provides the latest information on alternative investment funds and retail funds, including fund formation, restrictions on investors, the regulatory environment, operational requirements and the tax regime. Law and Practice 1

Jan 16, 2024Thomson Reuters Practical Law | Regulation of state and supplementary pension schemes in Luxembourg

A Q&A guide to pensions law in Luxembourg. The Q&A gives a high-level overview of the regulation of national government pensions and supplementary pensions. On national government pensions, it covers employer/employee contributions; national government pension age and monthly amount; and the public

Jan 04, 2024Chambers | Litigation Global Practice 2024 Guide

The 2024 Litigation Global Practice Guide features 70 jurisdictions. It provides the latest legal information on litigation funding, initiating a lawsuit, pre-trial proceedings, discovery, injunctive relief, trials and hearings, settlement, damages and judgment, appeals, costs, and alternative

Nov 20, 2023ThoughtLeaders4 Disputes Magazine | Enforcement of International Arbitral awards in Luxembourg

The Grand Duchy of Luxembourg has a favourable setting for arbitration generally, as well as for the enforcement of arbitral awards. The existence of the award, and the fact that it has obtained the exequatur are sufficient elements for obtaining interim remedies, while the latter is not necessary

Oct 27, 2023Entreprises magazine | Denouncing discrimination and bullying in the workplace

The issue of discrimination and moral harassment in the workplace has become even more topical since the recent adoption last April of the law on the protection of whistle-blowers. For more on this topic, read the article (in French) written by our Partner Anne Morel and Senior Associate Pauline

Latest Videos

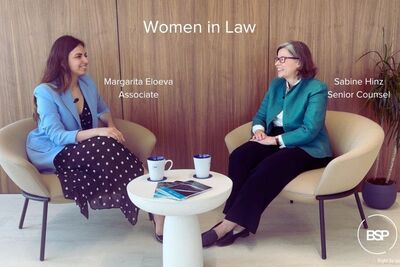

Oct 04, 2023Women in Law Series: Sabine Hinz

Sep 27, 2023Women in Law Series: Evelyn Maher

Sep 21, 2023Women in Law Series: Nuala Doyle

Sep 21, 2023Towards the modernisation of the Luxembourg fund industry

Sep 13, 2023Women in Law Series: Isabel Høg-Jensen

Sep 12, 2023BSP German Desk